By James Edmondson, Principal Technology Analyst at IDTechEx

By James Edmondson, Principal Technology Analyst at IDTechEx

Material demands for EVs are witnessing a rapid transformation in battery cells and its pack materials.

With ongoing supply chain disruption and rapidly evolving battery technology, the materials that will be in demand over the coming years will vary significantly.

According to its latest report published by IDTechEx, “Materials for Electric Vehicle Battery Cells and Packs 2023-2033”, takes a deep dive into battery chemistry, energy density, and design evolution to determine the market demand from 2021-2033 for 27 different materials in markets such as electric cars, buses, trucks, vans, two-wheelers, three-wheelers, and microcars.

Despite trends towards increased energy density and less use of materials per vehicle, thanks to the rapidly growing EV market, the demand for EV battery materials will grow over 12-fold, with market value exhibiting a 26% CAGR between 2021 and 2033.

Battery Cell Materials

Battery chemistry continues to evolve. The ultimate goal has always been towards higher energy density, but other factors such as cell cost and supply chain diversity have created a demand for alternative chemistries outside of typical NMC (nickel manganese cobalt). NMC chemistries provide the highest energy density, and to further improve this and avoid the use of cobalt, have transitioned to higher nickel variants such as NMC 811 over the previous NMC 111/523. Cobalt is a more costly material and has a very geographically constrained supply with questionable mining practices; the trend to higher nickel chemistries alleviates these concerns, albeit increasing demand for nickel.

Batteries using LFP (lithium iron phosphate) chemistries nearly exited the EV market in 2018-2019 thanks to their lower energy density than NMC. However, the need for a greater variety in cell supply and the ability to reduce costs has seen a huge resurgence in LFP adoption, especially in the lower- to mid-range market segments. The energy density hit of using LFP has been somewhat offset by improvements in packing efficiency. The greater adoption of LFP mitigates some of the demand for materials such as nickel and cobalt.

In addition to the cathode chemistry, there has also been an evolution in the anode. Some have been incorporating small percentages of silicon into anode to improve energy density, resulting in a decrease in graphite intensity in the cell. In the future, there is the expectation of seeing the adoption of much greater silicon contents with silicon-dominant anodes gaining interest.

There are several other materials critical to the operation of a battery cell, such as the collector foils, binders, and more. Even with energy density increases, IDTechEx is predicting a 9.4-fold increase in yearly demand for materials being used in battery cells.

Battery Pack Materials

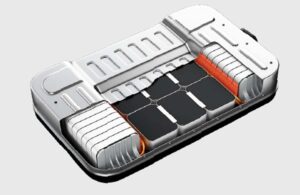

Increasing the energy density of battery cells is important, but the construction of the pack as a whole is also a great avenue to improve battery energy density. The market has gradually reduced the amount of materials used to package the cells, increasing the ratio of the pack’s weight and volume that is accounted for by the cells. The step change in this regard is the adoption of cell-to-pack designs where the modular nature is removed in favor of packing all the cells directly together. Despite the reduction in materials this causes, the rapid growth of the EV market means that many of the materials used in a battery pack will see increased demand.

The materials used to package cells into a pack have reduced by over 50% since 2015.

Thermal management is crucial to keeping cells at an optimal operating temperature and requires components such as cold plates and coolant hoses. Thermal interface materials are required to aid in heat transfer between the cells and the cooling structure. Preventing thermal runaway from propagating between the cells and outside the battery pack requires passive fire protection materials. How these thermal management materials and components are integrated is becoming simplified, especially with the adoption of cell-to-pack designs, but will remain as critical operating components with increased demand.

A key avenue for weight saving is the adoption of composites and polymers over traditional aluminum and steel. Much of the battery structure is made from aluminum, but many have adopted composite enclosure lids to reduce weight and form more complex shapes. There is a push towards multi-material battery enclosures to combine the benefits of the materials available. A key consideration for composite or polymer enclosures is EMI shielding and fire protection; this can be added later or integrated into the material itself.

IDTechEx’s latest report, “Materials for Electric Vehicle Battery Cells and Packs 2023-2033”, forecasts materials used in cells and packs, including aluminum, steel, copper, aluminum, lithium, cobalt, nickel, manganese, electrolyte, iron, phosphorous, binders, casings, carbon black, silicon, separators, carbon nanotubes, carbon fiber reinforced polymer, glass fiber reinforced polymer, thermal interface materials, fire protection materials, electrical insulation, cold plates, and coolant hoses.

For more info, please click here.