Spurred by the festive season in India, Sales of Electric Vehicles charged up in October and are expected to repeat, if not better, the same performance in November which has Diwali bang in the middle.

Overall Sales Trends of Electric Two-Wheelers in October 2023 would have reached higher if not for the “Shraddh” period (September 29-October 14). Nevertheless, EV demand turned out to be very strong in the second half of last month.

Electric Two-Wheelers witnessed a year-on-year (YoY) sales fall of 7 percent (October 2022: 77,267 units).

Despite the slashing of the FAME-II subsidy in the electric two-wheelers segment, over 2, 98,935 EVs have been sold since June 2023 at higher prices.

The electric two-wheelers and three-wheeler segments are significant contributors to the EV market in India. Taking a deeper dive into the Sales Trends of Electric Two-Wheelers in October 2023, let’s understand the market share and rankings of OEMs active in this segment.

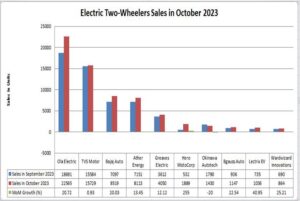

Sales Trends of Electric Two-Wheelers in October 2023

Here’s an overview of their sales trends:

According to the Vahan data, the cumulative sales of the first nine months of CY2023 were recorded at 691,536 units, 41% higher than January-October 2023 sales which stood at 489,726 units. The India EV sales have also surpassed the entire CY2022 retail sales of 631,174 units, and two months are remaining, showcasing a further increase in CY 2023 Electric Two-Wheeler Sales data.

According to the Vahan data, the cumulative sales of the first nine months of CY2023 were recorded at 691,536 units, 41% higher than January-October 2023 sales which stood at 489,726 units. The India EV sales have also surpassed the entire CY2022 retail sales of 631,174 units, and two months are remaining, showcasing a further increase in CY 2023 Electric Two-Wheeler Sales data.

Overall trends show that the two- and three-wheeler industry holds a market share value of 94% of the Indian EV market. Specifically, electric two-wheelers (e2Ws) account for 56% of total EV sales from January to October 2023, thus amounting to a total of 691,536 units.

On the other side, electric three-wheelers (e3Ws) have a 38.17% share, with 471,153 units sold around the same period.

India’s EV two-wheelers segment witnessed an overall spike in October 2023 with over 71,000 units of e2Ws sold, marking it as the best month since the FAME subsidy was slashed in June.

The e2W market has already surpassed the entire 2022 retail sales of 631,174 units, and it is anticipated that the year 2023 could end with total sales ranging between 750,000 to 800,000 units, translating to 18% to 25% year-on-year growth.

Brand Wise Sales Report of OEMs for October 2023

Once again ranked first place, Ola Electric maintained its market dominance in October 2023 with a 31% market share, which is then followed by TVS Motor Co with 22%. Another major OEM, Bajaj Auto has also shown strong sales while selling 8,519 Chetaks and surpassing Ather Energy. However, Ather has stood strong in third place with cumulative 10-month sales of over 88,390 units, compared to Bajaj’s 49,077 units.

Apart from the market share report of these OEMs, let’s dive deeper into the Sales Trends of Electric Two-Wheelers in October 2023.

Ola Electric recorded sales of 22,565 units in October 2023, registering a 21% MoM growth. They have already surpassed the 2, 00,000 units of sales milestone in the first ten months of CY2023.

Along with Ola Electric, its most popular S1 series of e-scooters has already touched 75,000 bookings.

Another key player, TVS Motor CO has witnessed a sales record of 15,729 units last month, registering 0.93 MoM growths.

This OEM generated 15,584 sales in September 2023, continuously maintaining a stable sales figure in the domestic market. According to the latest Vahan data, TVS sold 134,279 units of iQubes between January and October, on the other hand, iQube has achieved the 2, 00,000 units of sales milestone in just 45 months since it launched in January 2020.

Another popular two-wheeler brand in India with a large portfolio in the domestic market and flagship offerings like the Chetak scooter, Bajaj Auto has registered 8,519 units of sales in October, 20% up from September’s 7,097 units of sales.

On the other hand, Ather Energy has recorded monthly sales of 8,113 units which accounts for 13.45% of M-o-M growth when compared to the September 2023 7,151 units of sales figure. In July, Ather announced 100% on-road financing for its on-sale electric two-wheelers and also offered a 60-month loan product with a starting EMI of Rs 2,999.

Ranked fifth for this month, Greaves Electric Mobility has shown sales record of 4,050 units, registering 12% of M-o-M growth. However, the sister company of Greaves, Ampere Vehicles, stood at 15th position with sales of 352 units in October. Hence, the overall October month sales for this electric two-wheeler brand reached 4,402 units.

Hero MotoCorp, with the flagship offering Vida scooter, got 1,899 sales units in October and witnessed 255% MoM growth. In September 2023, Hero sold out 532 Vida scooters to domestic customers.

Okinawa Autotech has also secured its place in ranking at seventh position with October sales of 1,430 units, a 20% M-o-M decline when compared to September 2023, with sales of 1,790 units.

Bgauss Auto has witnessed one of the best monthly sales data in CY2023 with 1,147 units and 22% MoM growth. Other OEMs also saw a spike in the sales trend in their monthly sales, like Lectrix EV, which sold 1036 units and registered 41% of MoM growth, while Wardiwizard Innovations and Kinetic Green sold 864 units and 385 units of sales and 25% and 64% of MoM growth, respectively.

The overall 17% month-over-month growth in HS-E2W sales in Sales Trends of Electric Two-Wheelers in October 2023 and the dominance of the top 10 players in 91.89% of the market showcase both the expansion of the sector and the concentration of market power among a few key players.