India’s electric vehicle (EV) industry is transforming rapidly. While EV makers often attract the most publicity, a bigger story is unfolding in the shadows: the building of a robust ecosystem of component makers. A new supply chain era is emerging as India accelerates its electrification drive, led by Tier 1 and Tier 2 component makers who are adapting their operations to enable electric mobility.

The article delves into the key forces driving this transition, the rising role of Indian suppliers of EV parts, and its implications for manufacturers, lenders, and policymakers.

ICE to EV Transition: A Supply Chain Transformation

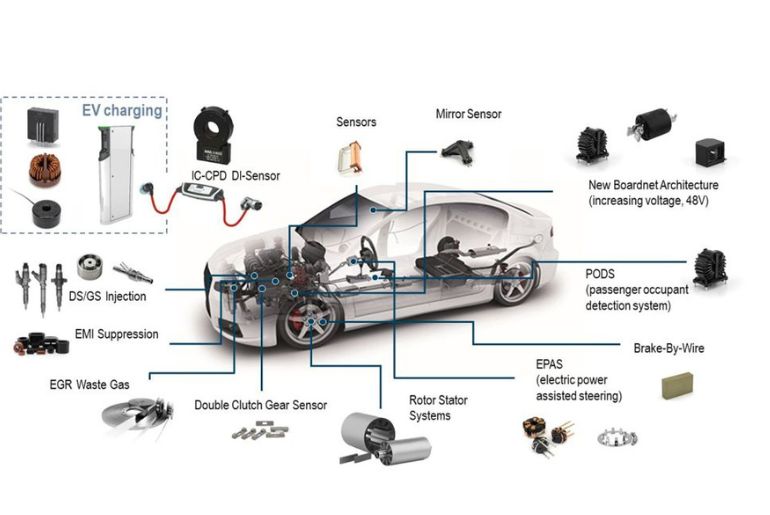

Cars that employ traditional internal combustion engines (ICEs) contain thousands of moving parts, ranging from engine blocks and exhaust sets to fuel injection systems. In contrast, despite EVs requiring fewer mechanical components, they are highly dependent on a new class of technologies, ranging from software-driven controllers to electric motors, inverters, thermal management systems, and battery management systems (BMS).

For businesses willing to make the shift from conventional automobile components to EV-specific ones, this shift is creating plenty of opportunities. EVs could reduce the number of parts per vehicle by as much as 30%, but in turn increase the need for precision-made and electronic components, finds a McKinsey report.

Key Drivers of Growth for EV Component Suppliers in India

1. Government Support

Local production of EV components is being directly promoted by government initiatives like the Make in India initiative, the PLI (manufacture Linked Incentive) Scheme for Auto Components, and the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme. Electric powertrains, batteries, and controllers are some of the advanced automotive technology components for which ₹25,938 crore has been allocated under the PLI scheme alone.

2. OEM Partnerships

For achieving component availability and reducing dependency on imports, Indian EV Original Equipment Manufacturers (OEMs) such as Tata Motors, Ola Electric, and Mahindra Electric are increasingly forging strategic partnerships with domestic suppliers.

To illustrate, top-tier 1 supplier Tata AutoComp Systems, for instance, has joined forces with South Korean company Tellus Power for electric vehicle charging infrastructure and China-based Gotion High-Tech for battery packs.

3. Localization Targets

Today, many OEMs have internal targets of getting 60–70% of their EV parts manufactured in the country. Besides reducing costs, this protects against global supply chain disruptions, like the semiconductors shortages that happened during the pandemic.

Who Are the Key Players?

Several Indian companies are quickly becoming indispensable in the EV supply chain. Here’s a look at some notable names:

1. Sona Comstar’s Sona BLW Precision Forgings

Sona Comstar supplies critical EV components such as gear systems, motors, and differential assemblies. The firm currently earns more than 25% of its revenue from EV components and has heavily invested in the evolution of traction motors and controllers for 2W and 3W EVs.

2. Bharat Forge

Bharat Forge, a major producer of industrial and auto parts, is stepping into the electric vehicle segment through its subsidiary Kalyani Powertrain. It supplies e-axles, electric drivetrain assembly, and light chassis parts for commercial EVs.

3. TVS Lucas

Lucas-TVS, which is a part of the TVS Group, has entered the EV component business with products such as charging systems, controllers, and BLDC motors. The company recently invested in a gigafactory to manufacture lithium-ion battery packs.

4. Varroc Engineering

This huge auto parts supplier is moving its focus to electric vehicle electronics, lighting, and battery enclosures. To focus on the EV transition, Varroc has divested a few non-core businesses.

5. Greaves Electric Mobility (component division of Greaves Cotton)

Greaves is not only producing electric scooters but also making motor controllers, chargers, and drive systems that other EV manufacturers utilize, especially in the low-speed 2W and 3W segment.

Emerging Segments within EV Components

The EV ecosystem is not limited to batteries and motors. Several component categories are now gaining traction among Indian suppliers:

Battery Management Systems (BMS): In order to enhance battery safety and efficiency, companies like Exicom, Nuvoco, and Log9 Materials are designing advanced BMS.

Thermal Management Systems: EVs need efficient thermal management for battery and cabin cooling, so manufacturers like Subros are redesigning HVAC systems for EVs.

Power Electronics: Organizations that are critical to power flow and performance, like HBL Power Systems and KPIT Technologies, are putting money into converters, inverters, and on-board chargers.

Software & Embedded Systems: As cars increasingly become software-defined, Indian IT and engineering services firms like Tech Mahindra, Tata Elxsi, and L&T Technology Services are offering diagnostics, telematics, and embedded software.

Challenges Faced by Indian EV Component Suppliers

Despite the growth, suppliers face several hurdles:

Capital Investment: Changing over to electric vehicle parts often requires retooling plants and acquiring new technical knowledge, which are costs that not all MSMEs can undertake.

Skilled Workforce: EVs require skills in electronics, software, and mechatronics—capabilities that are still evolving in India’s traditional manufacturing centers.

Global Competition: It is tough for Indian companies to grow rapidly in segments like battery cells and power electronics, which are controlled by Chinese and Korean suppliers.

Unpredictable Demand: Demand planning can be challenging for component manufacturers because of changing EV adoption rates, especially in the 2W and 3W market.

The Road Ahead: Opportunities for B2B Growth

The future looks promising for Indian EV component suppliers. A few key trends are expected to shape the next five years:

1. Integration Vertically

With the procurement of or investment in local component producers, additional OEMs will endeavor to vertically integrate. For Tier 1/2 suppliers, this presents opportunities for supply agreements and cooperative ventures.

2. Opportunities for Exports

India’s established manufacturing base is capable of fulfilling export demand, particularly for 2W and 3W parts, as international automakers seek low-cost EV parts.

3. Prioritize ESG and Green Finance

With global firms branching out into India, suppliers providing sustainable parts and backing ESG (Environmental, Social & Governance) goals would stand a greater opportunity to obtain contracts.

4. Sophisticated Ecosystems for R&D

Innovation is being encouraged along the value chain by government R&D initiatives and incubators like the Centre of Excellence for EVs and supplier programs of Ather Energy.

Conclusion

The objective of India’s EV transition is not just to introduce electric vehicles but to establish a complete ecosystem. A crucial phase in doing so is the development of component providers, which lead to cost-effectiveness, long-term viability, and a reduction in import dependence.

It is time for business-to-business (B2B) stakeholders, such as OEMs, investors, and Tier 1/2 suppliers, to engage and contribute to the evolving EV supply chain. Component makers will be at the forefront of this transformation as India becomes a global EV powerhouse, driving innovation, scale, and value.