The government of India should consider restoring the earlier subsidy regime for electric two-wheelers, said non-profit research organisation International Council on Clean Transportation (ICCT) in a new report, pointing out that electric two-wheeler (E2W) market has experienced a significant downturn in the year since subsidies were slashed.

In the study, titled “Electric vehicle demand incentives in India,” the body recommends the restoration of the ₹15,000/kWh subsidy until 2027 capped at 40% of the ex-showroom price that offered from June 2021 to May 2023.

Pointing out that battery prices are declining, it said the government can “gradually phase down the subsidy amount by type, in line with EV cost reduction trends”.

It noted that without subsidies, an electric two-wheeler can cost twice as much as a petrol two-wheeler. However, even with zero subsidies, an electric two-wheeler is today cheaper to own due to the lower fuel costs, it added.

However, it urged the government to restore the earlier subsidy of ₹15,000/kWh capped at 40% of the ex-showroom price, This, it pointed out, made the upfront cost of the electric two-wheeler 1.5 times that of the gasoline two-wheeler.

“In general, Indian two-wheeler consumers are highly price-sensitive and place high importance on upfront cost. Subsidies, therefore, play a key role in facilitating the upfront cost competitiveness of electric two-wheelers,” it noted.

The report noted that two-wheelers play an important role in meeting India’s overall transportation needs and offer a low-hanging fruit for emission reduction.

Two-wheelers “accounted for approximately 75% of the vehicle sales in the country in FY 2022–23. The segment is responsible for about 60% of India’s gasoline consumption, and tailpipe CO2 emissions from the segment have been estimated to be nearly 38 megatonnes annually.

“Rapid electrification of two-wheelers could significantly advance the pursuit of India’s energy security, climate mitigation, and vehicle electrification goals. Further, two-wheeler manufacturing capacity far exceeds that of any other vehicle segment in India and has the potential to more than double, to 50.6 million units annually, by 2026. There is thus high potential to develop local EV manufacturing capacity at scale, contributing to lowering EV battery and component costs,” it said in its report.

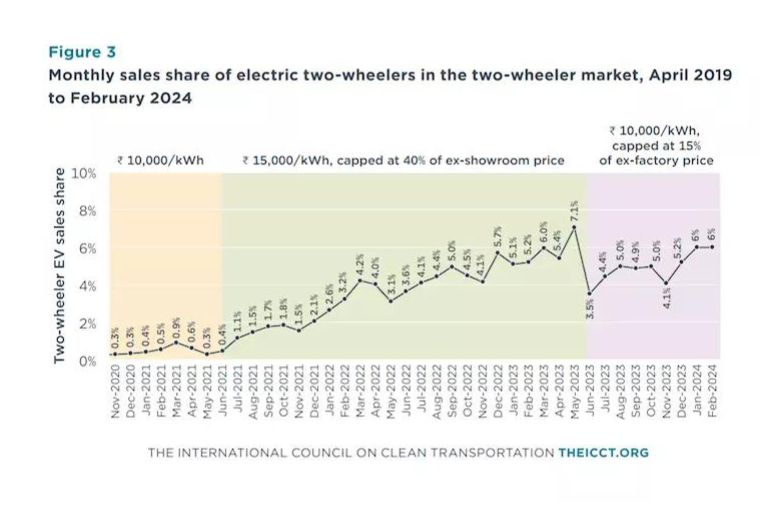

The report highlights a stark contrast in E2W sales before and after a subsidy reduction in June 2023, when subsidies were reduced from ₹15,000/kWh capped at 40% of the ex-showroom price to ₹10,000/kWh capped at 15% of the ex-factory price.

During the ₹15,000 subsidy period, monthly EV uptake rose from 0.4% of total two-wheelers in June 2021 to 7.1% in May 2023, the report noted, illustrating the positive impact of higher subsidies.

However, the market experienced a dramatic reversal following the subsidy reduction. “In the first month under the new subsidy, the EV uptake rate fell to 3.5% and E2W sales witnessed a month-on-month drop of 57%, falling to their lowest point in a year,” the ICCT report reveals.

The impact of the subsidy change was immediately felt by manufacturers and consumers alike. “E2W manufacturers either partially or fully passed on the amount of subsidy markdown to the consumer by raising the prices of their vehicles, which caused E2W sales to slow considerably,” the report notes.

While the market has shown signs of recovery, growth remains sluggish compared to pre-reduction levels. The ICCT analysis found that “E2W sales grew at a monthly average of 9% in the 6 months preceding June 2023, but an average of just 3% in the 6 months following the subsidy reduction.”

This volatility in the E2W market underscores the crucial role of consistent government support in nurturing India’s nascent EV industry. The report emphasizes that “rapidly changing policies create uncertainty in the EV ecosystem and make it challenging for stakeholders like manufacturers, investors, and consumers to undertake long-term planning, which risks slowing down the transition.”

This incident highlights the delicate balance required in crafting EV incentives. As India aims to increase its overall EV market share from the current 7%, the two-wheeler segment – which dominates the country’s vehicle market – will play a crucial role.

The report concludes that “continued and stable long-term policy support could help to enhance the affordability of E2Ws and boost demand for E2Ws in the country.”

As India navigates its electric mobility transition, the lessons from this subsidy reduction episode may shape the approach to future EV policies, potentially favoring more gradual and predictable changes to support sustained market growth.