Electric Vehicle (EV) Sales in June 2023

Channeling the concerns of climate change and the need for sustainability into the adoption of clean energy resources, electric vehicle domain has flourished at a striking rate in the last few years.

Stepping in the first week of June 2023, the electric mobility market of India has seen a shocking downfall in electric two-wheelers sales as compared to its monthly sales data for May 2023.

However, before discussing the reasons behind this sudden pitfall, let’s check out the overall market scenario of India’s Electric Vehicle (EV) Sales in June 2023.

For the first time, retail sales of electric vehicles in India have surpassed the 700,000-unit mark in the first half of the calendar year 2023.

By the end of June 2023, the total sales of this year were recorded at 721,971 units, which is typically 73% of India EV record sales in CY2022.

Taking a massive hit as per Vahan dashboard’s findings, India’s EV Sales in June 2023 has shown a drop of 1,01 832 units as compared to the May EV Sales recorded at 1,58,097 units.

The overall EV Sales in June 2023 witnessed an MoM decrease of around 35% to reach 1,01,832 units, while on a YoY basis, India’s EV Sales in June 2023 increased by 39% as compared to EV sales in June 2022.

However, cumulative numbers reached a new record for India’s EV Sales in June 2023, wherein the difference in numbers crossed over 150,000 units in May.

This aforementioned gap, as compared to the first-half CY2022 total, would have gone past the 750,000-units mark if not for the sharp 56% month-on-month decline in June sales in the two-wheeler segment.

Following this trend, India’s EV Sales in June 2023 have now become the ninth consecutive month that EV sales have crossed the 100,000 mark.

This huge drop in India’s EV Sales in June 2023 can also be attributed to the sudden announcement of reducing FAME-II subsidies for electric two-wheelers.

Reduction of the FAME II subsidy from 40% to 15% as per the new amendment has resulted in hiked prices of e-scooters and e-motorcycles from June 1.

Due to this, electric two-wheeler sales went down to an 11-month low of 45,734 units last month. As a result, June’s electric two-wheeler sales have been recorded at a drop of 56% as compared to May 2023’s sales record numbers.

Out of 1,01,832 EVs sold in June 2023, electric two-wheelers have accounted for 45,734 units after the massive drop and three-wheelers accounted for 48,009 units.

On the other hand, electric passenger vehicles, which have witnessed a growing demand amidst the personal usage consumer transition to e-mobility, India’s EV Sales in June 2023 accounted for 7,692 units.

In the end, electric buses witnessed 200 units which is a considerable decrease from its previous month’s sales of 274 units in May 2023.

Considering the sales figures of each sub-segment according to their monthly EV sales performance, let’s take a look at some of the notable sales figures of each domain along with the company-wise retails.

Electric Two-Wheelers Segment Sales – June 2023

This booming segment took a nose dive in retail sales in June 2023 due to the government’s decision announced on May 22 to revise the subsidy on the FAME India Scheme to Rs 10,000 per kilowatt per hour (kWh) as against Rs 15,000/ kWH.

As a result, the incentive cap for the FAME-II scheme subsidy has been reduced to 15% for the two-wheeler EV’s ex-factory price as against the 40% benefit extended earlier.

This 37.5% cut directly affected electric vehicle prices, leading to a sales decline in the two-wheelers segment with 45 829 units sales for June 2023 as compared to 1,04 829 units’ sales in May 2023.

Compared to the sales record of the previous year, electric two-wheeler showed a 3% jump on a yearly basis, i.e., June 2022, with 44,381 units sold in total.

Out of the 135 EV two-wheeler OEMs, the top eight firms managed to hold their positions and accounted for 39,637 units or 86.66% of total sales in June.

However, they, too, were not spared in the subsidy mess that impacted their sales as a result of the slashed FAME subsidy.

Retaining its leadership position, Ola Electric fared considerably well with a fair margin of 38% share as it sold a total of 17,572 units, down to 39% MoM, with May 2023 recording 28,629 units.

TVS Motor Co jumped to second rank with sales of 7,807 units of iQube e-scooters last month, which went down to 62% as compared to May 2023’s 20,397 units.

This was followed by Ather Energy with 4,543 units, down to 71% as compared to May 2023’s 15,407 units.

Bajaj Auto recorded 2,987 units in June 2023, as compared to May 2023’s 9,965 units with a 70% MoM percentage.

Looking at the six-month data of the total 135 OEMs in the market, the Top 10 EV makers witnessed sales of 391,218 units, having a 90% share of the total 4,34,914 units sold.

Looking at the sales figure and the positions according to their monthly sales, Ola Electric recorded booming sales at 125,729 units making up for 29% market share and the company is ahead of TVS Motor Co by 48,760 units.

TVS sold a total of 76,969 iQube scooters, giving it a 17.69% share. The third position is snatched by Ather Energy, with 59,221 units and a 13.61% share.

Ampere Vehicles (39,114) and Hero Electric (25,502) are hence, ranked fourth and fifth, respectively. Bajaj Auto, on the other hand, stands in sixth position.

Okinawa (21,503) is at seventh and last but not least, Okaya EV (10,124) has made it to eighth position.

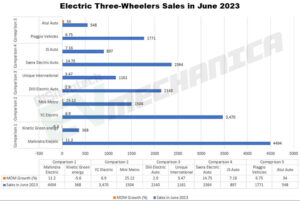

Electric Three-Wheelers Segment Sales – June 2023

Talking about the commercial units of the electric vehicle segment, three-wheeler EVs have recorded consistent growth in India’s EV Sales in June 2023 and cumulative January-June sales indicate strong YoY increases.

Last month, the segment witnessed retail growth of 48,009 units, which is up to 72% YoY growth as compared to June 2022’s 27,853 units.

Sales of registered passenger and cargo-type electric three-wheelers in Jun 2023 stood at 42,923 units and 5,086 units, respectively, with a MoM increase of 9% in passenger E3W and a 2% decrease in E3W cargo.

In total, E3Ws sales witnessed a MoM rise of around 7.5% over the last month.

India has seen tremendous growth in sales of electric three-wheelers largely due to sustained demand for passenger transportation and the expansion of last-mile operator services catering to e-commerce applications, food deliveries and others.

Checking out the cumulative sales of the top eight electric three-wheeler players across passenger and cargo segments in June 2023, their sales share accounted for a 37.81% share of the entire E3W market.

Mahindra and YC Electric came in at first (9.36% share) and second (7.23% share) positions, respectively.

The previous month’s 4,494 units are considered to be the best-ever monthly sales yet for this budding segment. MLMM, with its expanded manufacturing capacity, launched a new line for its Treo electric three-wheelers as it stood in the first place.

YC Electric Vehicles, with 17,506 units, is ranked second and has a 7% market share. A commendable performance for this five-product company which has the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC Electric. In third place is Saera Electric Auto with 12,121 units and a 5% share, followed by Dilli Electric with 11,035 units and Piaggio Vehicles with 8,409 units.

Following the trend, sales showed Saera Electric Auto at 4.92%, Dilli Electric at 4.46%, Piaggio at 3.69%, Mini Metro at 3.13%, Hotage Corporation at 2.57%, and Champion Poly Plast at 2.45%.

These OEMs cumulatively account for 102,257 units and 41.54% of total sales, leaving the balance 59% of the electric three-wheeler market to the other 440 OEMs.

Electric Car Sales — June 2023

Witnessing new sales growth in an electric car and SUV sub-segment for India’s EV Sales in June 2023, the Electric Passenger Vehicles sales were recorded at 7,774 units, witnessing a MoM rise of around 2%.

Accounting for sales records on a YoY basis, Electric Car sales in June 2023 have surged by more than around 97.41% from that of electric car sales in June 2022.

Crowned at the top, Tata Motors has been driving electric car sales with a record of 5,368 units at 69.30% of the market share this month as well; however, it has witnessed a decrease in monthly sales, while MG Motor has seen a fresh increase in sales this month.

Following Tata’s car sales record, a new surge of EV registrations of MG Motor was seen in June 2023 at 1,127 units, with a 14.5% market share.

Giving new competition with the launch of Mahindra XUV400, Tata’s first real rival to the Tata Nexon EV, Mahindra & Mahindra (M&M) has been placed at third position with recorded 397 units and a market share of 5.1%.

BYD India has clocked sales of 181 units and a market share of 2.3%.

PCA India, which retails the Citroen eC3, the electric version of the C3 hatchback, moves into fourth place with 325 units, ahead of Hyundai Motor India (159 units) and BMW India (92 units).

Electric Bus Sales — June 2023

Electric buses have shown tremendous potential during this year’s sales as the figures reach three figures in the last two months. Talking about the India’s EV Sales in June 2023 based on electric commercial vehicles like e-buses, the figures show a decline in sales to that of previous month.

According to the recent data, cumulative sales of electric buses in June 2023 accounted for 200 units, witnessing a huge decrease in MoM sales by ~27%.

However, the segment witnessed growth on a YoY basis, as electric bus sales in June 2023 increased by ~37% from that of E-Bus sales in June 2022.

Leading the helm with 76.5% market share, Tata Motors sold 153 units in June 2023, followed by PMI Electro Mobility with 19 units at 9.50% market share, Olectra Greentech at 6.50%, Mytrah Mobility at 5 %, and Switch Mobility at 2.5% market share.