Committed to achieve the goal of reaching net carbon neutrality, global automotive businesses are leaning their priorities toward sustainable mobility and clean energy fuel. Named as the ambassador of green mobility, Electric Vehicles (EVs) and their Aftermarket have witnessed lightning growth in the last decade.

Committed to achieve the goal of reaching net carbon neutrality, global automotive businesses are leaning their priorities toward sustainable mobility and clean energy fuel. Named as the ambassador of green mobility, Electric Vehicles (EVs) and their Aftermarket have witnessed lightning growth in the last decade.

Specifically, Indian EV Aftermarket Industry has witnessed major upheavals since the introduction of next-generation vehicles.

In general, automotive aftermarket is nothing but, taking care of vehicles after they are sold to customers.

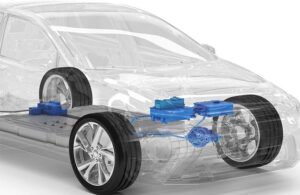

EV Aftermarket typically includes providing support for limited spare parts, battery charging, charging stations, normal mechanics, general workshops, etc.

In other words, Indian EV Aftermarket Industry is the sector that deals with the manufacturing, distribution, retailing and installation of vehicle parts, accessories, equipment and services after the sale of the original vehicle.

It includes products and services such as tyres, batteries, lubricants, filters, brakes, wipers, lights, audio systems, car care products, diagnostics, repairs and maintenance.

According to a report, the Indian Automotive Aftermarket Industry was valued at USD 9.8 billion in 2020 and is predicted to grow at a CAGR of 10.5% to reach USD 16.1 billion by 2025.

Challenges in the Indian EV Aftermarket Industry 2023

Some of the challenges faced by the Indian EV Aftermarket Industry are,

Some of the challenges faced by the Indian EV Aftermarket Industry are,

- The prevalence of counterfeit products and grey market in the aftermarket, not only causes a huge financial loss to the original brands but also pose a great risk to vehicle safety and performance

- The lack of standardization and regulation in the aftermarket, which leads to inconsistency in quality, pricing and service delivery among different players12.

- The impact of the COVID-19 pandemic on the Indian EV Aftermarket Industry has disrupted the supply chain, reduced the demand and affected consumer behavior and preferences.

- The increasing competition from the original equipment manufacturers (OEMs) and authorized service centers (ASCs), which are expanding their presence and offerings in the Indian EV Aftermarket Industry to retain their customers and capture a larger share of the sector.

Trends in the Indian EV Aftermarket Industry 2023

Major trends Driving Growth of the Indian EV Aftermarket Industry includes,

Major trends Driving Growth of the Indian EV Aftermarket Industry includes,

- Growing Demand: The Indian EV Aftermarket Industry has been experiencing significant growth due to the expanding vehicle population, increasing disposable income, and a shift toward vehicle ownership.

- E-commerce and Digitalization: The Indian EV Aftermarket Industry is witnessing a shift towards e-commerce platforms and digitalization. Online marketplaces and platforms have emerged as popular channels for purchasing automotive parts and accessories, providing consumers with convenience and a wide range of options.

- Genuine and Branded Parts: With the rise in consumer awareness and concerns over product quality, there is a growing preference for genuine and branded parts in the Indian EV Aftermarket Industry. Consumers are willing to pay a premium for reliable and authentic products.

- Customization and Personalization: There is a rising trend of customization and personalization in the Indian aftermarket. Consumers are looking for unique accessories and modifications to enhance the aesthetics and performance of their vehicles.

- Service and Maintenance: As vehicles age, the demand for maintenance and repair services increases. This has led to the growth of service and maintenance centers across the country, including authorized service centers and independent workshops.

Key Players of the Indian EV Aftermarket Industry 2023

Some of the notable players in the Indian EV Aftermarket Industry are:

Some of the notable players in the Indian EV Aftermarket Industry are:

- Tyre manufacturers such as MRF, Apollo Tyres, CEAT, JK Tyre and Bridgestone, offer a range of products for different segments and vehicles.

- Battery manufacturers range from Exide Industries, Amara Raja Batteries (Amaron), Luminous Power Technologies and Okaya Power Group, which cater to various applications such as automotive, industrial and renewable energy.

- Lubricant manufacturers such as Castrol India, Indian Oil Corporation (Servo), Hindustan Petroleum Corporation (HP Lubricants), Shell India and Gulf Oil Lubricants India, provide a variety of products for different engines and vehicles.

- Filter manufacturers like Mahle Filter Systems India, Mann+Hummel India, Bosch India and Elofic Industries, supply filters for air, oil, fuel and cabin applications.

- Brake manufacturers include Bosch India, Brakes India, Rane Brake Lining and ASK Automotive, which offer brake pads, shoes, discs and drums for various vehicles.

- Wiper manufacturers such as Bosch India3, Valeo India and Trico Products India, produce wiper blades for different weather conditions and windshield types.

- Light manufacturers such as Lumax Industries, Varroc Engineering, Minda Industries and Neolite ZKW Lightings, manufacture headlamps, tail lamps, fog lamps and other lighting products for various vehicles.

- Audio system manufacturers such as Harman International India (JBL), Pioneer India Electronics (Pioneer), Sony India (Sony) and Panasonic India (Panasonic), provide car speakers, amplifiers, subwoofers and other audio accessories for various vehicles.

- Car care product manufacturers include 3M India (3M), Wuerth India (Wuerth), Turtle Wax India (Turtle Wax) and Waxpol Industries (Waxpol), which offer products for cleaning, polishing, protecting and enhancing the appearance of vehicles.

- Diagnostic equipment manufacturers like Bosch India, Snap-on Tools India (Snap-on), Autel Intelligent Technology (Autel) and Launch Tech Co. (Launch), which provide tools and devices for testing.