As electric vehicles (and electrification technology) grow in popularity among consumers and ecosystem players, a greater focus has been placed on ethical and sustainable operations and processes throughout the value chain. Ecosystem players are looking to double down on the shifting trends toward sustainability by implementing more ethical standards throughout the battery life cycle; from mining practices to battery second life.

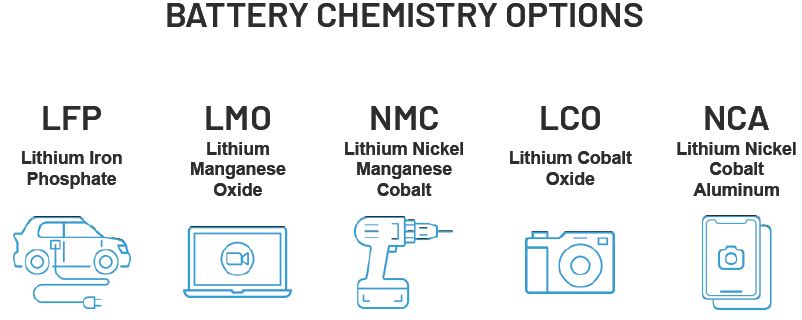

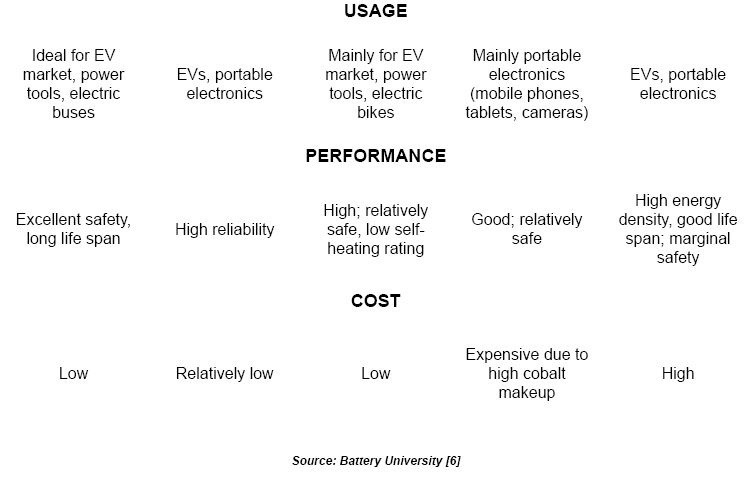

Today, most Lithium ion batteries use the chemical element cobalt as a foundation for their cathode material (the portion of the Lithium ion cell which determines storage capacity). Cobalt cathode cells provide longer-range performance and lower difficulty in charge measurement and management, when compared to other chemistries. However, the mining of cobalt has long been a hotly contested topic.

COBALT: AN ETHICAL QUANDARY FOR EV BATTERY TECHNOLOGY

Approximately 70% of the world’s cobalt is mined in the Democratic Republic of Congo (DRC), a country well known for its poverty, corruption and human rights issues. The mining of cobalt specifically in the DRC has been linked to child labor practices, unsafe mining conditions and the mistreatment of miners, as well as other violations. As the electrification ecosystem looks to embrace both social and environmental sustainability, interest has grown in both reduced-cobalt battery chemistries (NMC and NCA) and cobalt-free battery chemistries like lithium iron phosphate (LFP). Many manufacturers are welcoming such a move. In fact, Tesla has plans to accelerate its path to sustainable energy by making high-energy cells with less or no cobalt

Approximately 70% of the world’s cobalt is mined in the Democratic Republic of Congo (DRC), a country well known for its poverty, corruption and human rights issues. The mining of cobalt specifically in the DRC has been linked to child labor practices, unsafe mining conditions and the mistreatment of miners, as well as other violations. As the electrification ecosystem looks to embrace both social and environmental sustainability, interest has grown in both reduced-cobalt battery chemistries (NMC and NCA) and cobalt-free battery chemistries like lithium iron phosphate (LFP). Many manufacturers are welcoming such a move. In fact, Tesla has plans to accelerate its path to sustainable energy by making high-energy cells with less or no cobalt

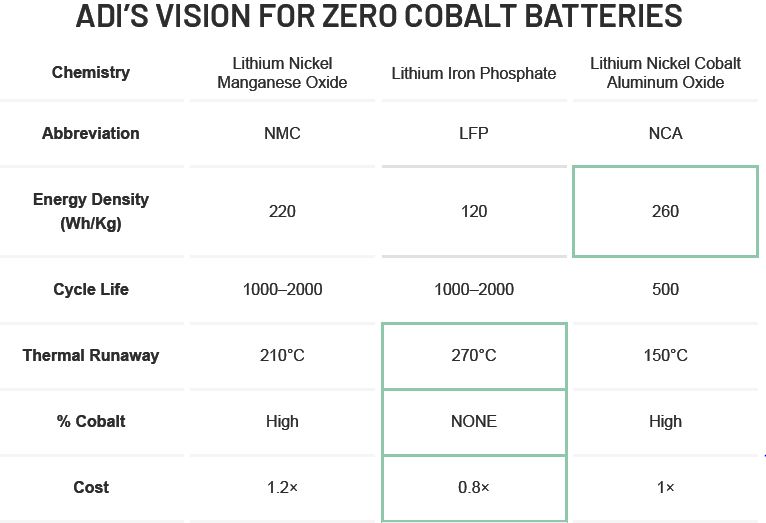

LFP batteries are proven in production, having been used in the industry for over 10 years, and are fully supported as the primary technology of choice by leading OEMs. However, cobalt-based chemistries deliver 10%-20% more energy density resulting in a longer range per charge. But with this added performance comes an added risk, as cobalt’s lower flash point—compared to LFPs—poses greater risk for battery fires. In addition, LFP batteries can be manufactured at a lower cost and are more efficient at handling safety hazards like punctures or thermal runaway issues. The high power capability of LFPs also enables faster charging.

LFP batteries are proven in production, having been used in the industry for over 10 years, and are fully supported as the primary technology of choice by leading OEMs. However, cobalt-based chemistries deliver 10%-20% more energy density resulting in a longer range per charge. But with this added performance comes an added risk, as cobalt’s lower flash point—compared to LFPs—poses greater risk for battery fires. In addition, LFP batteries can be manufactured at a lower cost and are more efficient at handling safety hazards like punctures or thermal runaway issues. The high power capability of LFPs also enables faster charging.

EV manufacturers are looking to use today’s battery technologies in higher priced, higher performance(range) vehicles in their fleet, while leveraging LFPs in their lower range vehicles. These lower range vehicles can be delivered to the public at a much more affordable price point due to the cost savings provided by eliminating cobalt. While LFPs offer a cheaper sticker price and safer operation than cobalt, its chemistry is the most difficult to accurately measure battery charge due to a flatter discharge curve.

This is where Analog Devices, Inc. (ADI) and its battery management systems (BMS) solutions can help.

ADI produces the industry’s most accurate battery state-of-charge measurement. The accuracy of ADI’s BMS solutions greatly reduces the burden placed on automotive manufacturers by providing a technology that can effectively manage the state of charge demands of LFPs, thus unlocking the potential cost and safety benefits LFPs can provide to the industry. In addition, LFP’s higher power density, longer life cycle, and lower cost of operation over a wider temperature range, make it ideal for battery second-life applications like energy storage.

BENEFITS OF ZERO COBALT

- Low cost structure

- Immune to thermal runaway

- Ideal for entry level electric vehicles

- No child or forced labor

Ultimately, LFPs will drive accelerated consumer adoption of EVs by reducing the price barriers to EV ownership. Currently, 51% of an EV’s sticker price is related to the battery7. In addition, a move away from a heavy reliance on cobalt will push the industry to a more ethical supply chain, while the benefits that LFPs offer translate into a more environmentally sustainable battery ecosystem and greater efficiency for battery second life applications.

1Dafydd Davies. Restrictions on sourcing of cobalt are changing. pv magazine, March 10, 2020.

2Bridie Schmidt. Tesla has been using high-energy nickel 4680 batteries for months. The Driven, September 28, 2020.

3Nickel price. (2021, January 11). Retrieved from https://markets.businessinsider.com/commodities/nickel-price.

4Aluminum price. (2021, January 11). Retrieved from https://markets.businessinsider.com/commodities/aluminum-price.

5Manganese price. (2021, January 11). Retrieved from https://tradingeconomics.com/commodity/manganese.

6BU-205: Types of Lithium-ion. (2021, January 11). Retrieved from https://batteryuniversity.com/learn/article/types_of_lithium_ion.

7Gustavo Henrique Ruffo. How Much Does The Powertrain Represent Out Of Total Cost For An EV? InsideEVs, February 5, 2020.