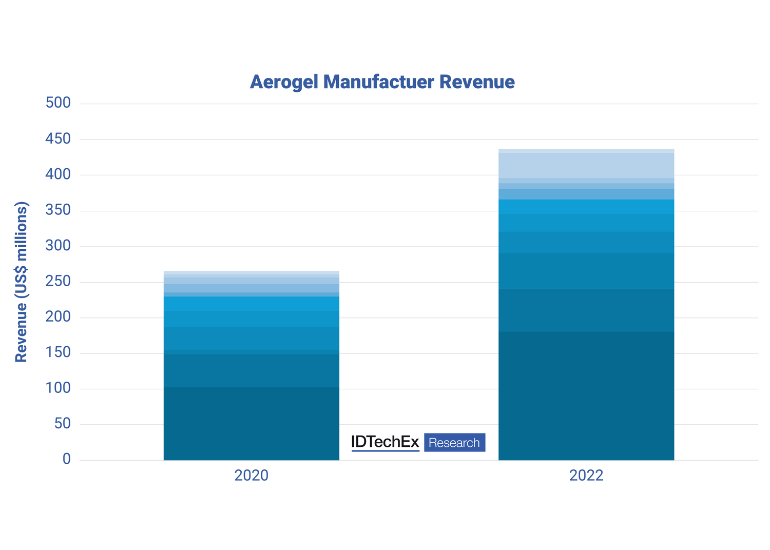

The aerogel market has grown steadily and slowly in the past. In order to meet the growing demand for thermal insulation and fire protection in batteries for electric vehicles (EVs), aerogel producers are planning large-scale expansions and investments. According to IDTechEx, demand for aerogel revenue for EV battery applications will increase by a factor of more than twelve.

EV batteries have an optimal operating temperature similar to that of humans. Too hot or too cold, they can experience reduced performance, increased degradation, or safety hazards. This is where aerogels can help. Aerogels are extremely good thermal insulators with a thermal conductivity of around 0.02W/mK. When used as a cell-to-cell barrier, the aerogel layer can help keep more heat in the cells in cold ambient conditions and help prevent heat transfer between cells in an overheating scenario. Aerogels also provide protection in the event of thermal runaway, with many products stating fire protection above 1000°C. Aerogels are also extremely lightweight, often in the region of 1-10kg/m3, meaning they have a low impact on the battery’s energy density.

According to a report by IDTechEx, “Aerogels 2024-2034: Technologies, Markets and Players”, predicts that EV batteries will be the dominant application of aerogels by as early as 2025Thanks to the above properties, and despite some of the typical drawbacks for aerogels (primarily handling and costs), they are seeing increased adoption in the EV market.

According to a report by IDTechEx, “Aerogels 2024-2034: Technologies, Markets and Players”, predicts that EV batteries will be the dominant application of aerogels by as early as 2025Thanks to the above properties, and despite some of the typical drawbacks for aerogels (primarily handling and costs), they are seeing increased adoption in the EV market.

In order to meet these demands, manufacturers of aerogels are increasing their manufacturing capacity. Market leader Aspen Aerogels has contracts in place to supply GM and Toyota EV models and has committed to a US$325 million investment for its “Plant II” in Georgia, US, which will also provide 250 new jobs.

IBIH are a key player in China for aerogels in EV batteries providing large Chinese EV OEMs and battery makers. It has a second line expected to be completed by the end of 2023 that will triple its manufacturing capacity ready for further progression in the EV market.

JIOS Aerogel is another player that has big plans. In November 2023, JIOS opened a new manufacturing plant in Singapore to produce its “Thermal Blade” product for EV battery applications.

There are many more players in the aerogel market with expansions planned. IDTechEx has analyzed over 70 players, with over 30 of these being founded in the last 10 years and, hence, still in the expansion phase.

With the rapidly growing EV market and increased focus and regulation relating to EV thermal runaway and fire safety, the aerogel market has a large opportunity for continued expansion and growth. However, it will face stiff competition from competing materials such as encapsulating foams, ceramic-type materials, intumescent coatings and components, and many more.

IDTechEx has been studying the aerogel industry for many years, with technical experts conducting an extensive number of primary interviews and detailed assessments of this industry. The report says benchmarks aerogels against other fire protection materials for EV battery packs, along with the players, their revenue, capacity, and market progress. The report also considers other applications such as oil & gas, LNG pipelines, electronics, and more.

For more information, click here